This is a carousel with one large image and a track of thumbnails below. Select any of the image buttons to change the main image above.

Esprit Sweaters

Esprit Sweaters

Collection: Beach House

-

Extra 10% off with code SAVE10 until 3/26/2024!Save an extra 10% off select eligible items with code SAVE10 at checkout. Bellacor PRO customers are not eligible for the discount. Excludes Sale, Limited Time Deal, Clearance, Doorbusters and Open Box items. Discount cannot be applied to previous orders.

20+ In Stock

Please log in or create an account to access the project tools.

Description

Vivianyo HD Mens Sweaters for the Winter Men's Fashion Winter High Neck Warm Outdoor Long Sleeve Knitted Sweater Top Flash Picks Gray

Sweaters For Teen Girls, Women's Cute Sweater Knitted Long-Sleeve Crewneck Women's Autumn And Winter Splicing Knit Sweater Round Neck Long Sleeve Striped Sweater Crew Neck Pullover (L, Sky Blue)

LILLUSORY Women's Sweaters 2023 Winter Zipper Collared Oversized Drop Shoulder Tunic Pullover Knit Sweater Tops Apricot at Amazon Women's Clothing store

Men's Irish sweater, mens fisherman sweaters, wool sweater

How to care for and store your sweaters, according to experts

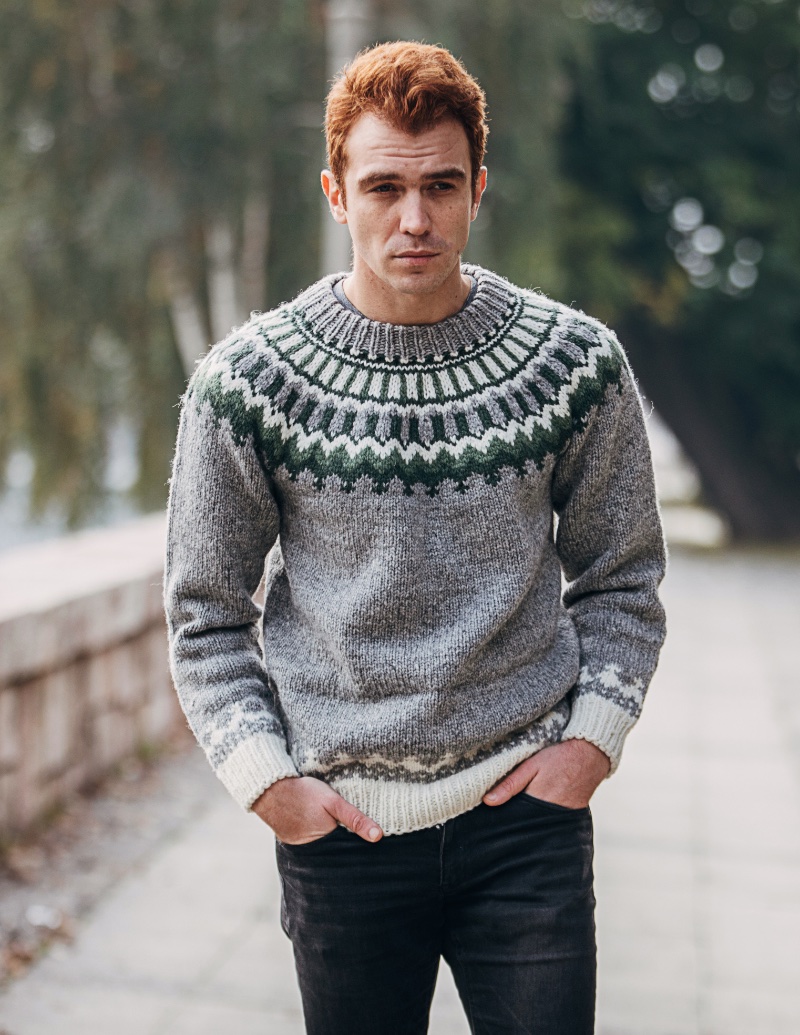

Nostalgic Sweater | Men's Sweaters | Outerknown

Baylands Fisherman Sweater

Types of Sweaters for Men: Discover the Essential Styles

15 Best Oversized Sweaters 2024

The 15 Best Wool Sweaters for Men in Winter 2024

Men's Cable Knit Crew Neck Aran Wool Sweater [Free Express Shipping]

![Men\'s Cable Knit Crew Neck Aran Wool Sweater [Free Express Shipping]](https://cdn11.bigcommerce.com/s-scgdirr/products/17595/images/92077/C1347_-_Moss_Green__69889.1676391063.560.850.jpg?c=2)

Best Fall Sweaters 2024

Shaker V-Neck Sweater - Coldwater Creek

Men's Signature Organic Cotton Rollneck Sweater | Sweaters at

Penkiiy Sweaters for Men Men Winter Casual Pullover Loose Knitted Round Neck Stitching Sweater Coffee Sweaters

20 Best Sweaters for Men in 2024, Reviewed by Experts

Merino Wool Adult Fishline Sweater - Nui Organics

Best Sweaters For Women 2024 | POPSUGAR Fashion

:upscale()/2023/10/24/896/n/1922564/7ea529756538296fcc9970.27462972_Screen_Shot_.png)

The 10 Best Wool Sweaters of 2024

:max_bytes(150000):strip_icc()/is-best-wool-sweaters-tout-5865cd6408d9436495bd57365df84b0b.jpg)

Women's Fuzzy Knit Long Sleeve Sweater by ANRABESS - Fall Fashion, Crew Neck, Loose Fit, Chunky Knit, Warm Cashmere Pullover at Amazon Women's Clothing store

The Best Sweaters for Men: Top Brands to Know in 2024 | WERD

20 top-selling women's sweaters to buy before winter

Cute Sweaters for Women Knitted Pullover Sweaters Long Sleeve Womens Tops for Work Plus Size Cardigans for Women Argyle Sweater Women Vneck Pullover Men(01-Beige,S) at Amazon Women's Clothing store

Latte Garter Stitch Cardigan Sweater for Babies and Toddlers - Huggalugs

The 18 Best Sweaters for Men of 2024

:max_bytes(150000):strip_icc()/Best-Sweaters-for-Men-TL-tout-36700df70d7a4f438d39fa03442986a0.jpg)

How Hand-Knit Sweaters Become Luxury Menswear's Newest Status Symbol

24 best fall sweaters under $50 for 2023 | CNN Underscored

Men's Crew Neck Sweaters | Rank & Style

Slate Garter Stitch Cardigan Sweater - Huggalugs

Delcia Sweater | Made Trade

Shipping and Returns

Item ships by FedEx/UPS Ground Shipping.

Usually Ships in - 1 to 5 business days

Is this item Returnable?

Yes, within policy terms, no restocking fee, customer pays return shipping costs.

Is this item Cancellable?

Yes, requests are not guaranteed and are dependent on the status of the order. See cancellation policy.

Reviews

Q & A

This is a carousel with tiles that activate modal dialogs. Use Next and Previous buttons to navigate, or jump to a slide using the slide dots.